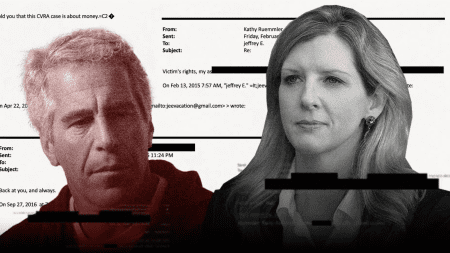

Kathy Rummler, a senior consultant at Goldman Sachs, is set to step down from her position as a consultant to disgraced financier Jeffrey Epstein in 2026. This comes amid mounting pressure following the release of a new batch of documents by the U.S. Department of Justice, which began with emails containing personal details between Rummler and Epstein that sparked widespread controversy in the financial news industry.

Rumler, who held a general legal and administrative position at a prominent charity and served as an advisor to the White House during the administration of former U.S. President Barack Obama, announced in a statement that she has decided to step down from her position effective October 30, 2026. She stated that she made this decision “in the best interests of the company,” as she faces significant scrutiny regarding her statements amidst this climate controversy.

The controversy surrounding the series of emails exchanged between Rummler and the White House, between 2014 and 2019, has raised questions about the nature of her communications with them. In those emails, Rummler addressed Epstein in colloquial terms, including calling him “Uncle Jeff” (Uncle Jeffrey). Her gratitude for the lavish gifts she received from him, most notably furs, was evident, even though Epstein had been charged with sex crimes since 2008.

These emails, part of a larger batch of documents released today by the U.S. Department of Justice, not only confirm the personal relationship but also reveal information about Rummler’s advice to Epstein on how to handle media investigations—essentially, anything Epstein could use to counter the scrutiny of journalists and Donny Farr.

She was a lawyer on the previous judicial panel and was supposed to be a purely formal official. However, in her recent statement, she acknowledged that “the media attention I personally received because of these documents has become a distraction” from the bank’s interests, suggesting that it would be best for her to step down so the bank could focus on addressing the issue.

For this reason, David Solomon, CEO of Goldman Sachs, decided to respect her decision, praising her new role in leading the legal department and overseeing matters related to competence and ability within the firm. While Romel was “one of the many talents in the business,” her departure would be deeply missed by the team, with a certain degree of appreciation for her time at the firm.

It’s worth noting that Romel’s tenure at Goldman Sachs was relatively short, having served as White House legal counsel from 2011 to 2014. She was not a well-known legal figure within the administration during her time at Goldman Sachs, where she managed several internal legal matters related to Peruvian policies.

These questions have raised widespread concerns within the financial community about a culture that acknowledges the shared responsibility of executives and businesspeople, especially when it comes to prominent figures like Epstein, who was involved in criminal cases before his death in prison during his trial in 2019. This is part of a broader business debate on Wall Street regarding the need for executive reductions in major financial institutions.

Furthermore, the documents released under the Epstein Files Transparency Act (Epstein Files Transparency Act) have shed light on the involvement of individuals, in various ways, with Epstein over decades, effectively removing the “water from the water” from American waters.

This legal and ethical scandal continues to be a subject of discussion within major financial institutions, while Goldman Sachs is considering a new arrangement for its legal advisors, with the official responsible for “water from the water” and managing relationships personally involved in the controversy. Until then, Cathy’s case and her resignation from Goldman Sachs will be one of the most significant events in the ongoing saga of the relationship between money and justice, culminating in the end of 2026.

Leave a Reply